In this economy, I think that everyone has to budget their money. And with twins, it is even more important, because their Doctor visits, Diapers, Formula, clothes, daycare, etc. So my wife and I sat down and looked at where we were financially and started making some tough decisions on what we needed to cut out. I will break out what we did before the boys were born, what we have done since the boys were born and what we are working on now.

Before the boys we did the following:

1) Read the Dave Ramsey book The Total Money Makeover

2) Used the Debt Reduction Calculator and we keep this updated on a monthly basis. This allows us to know where we are at any point in time each month.

3) After we found a nanny and decided on a price for her to keep our boys, we started taking what we would be paying her each week and putting it into savings. We needed to see what life would be like without that money. And because I have been asked a few times, we used Care.com to find our nanny and were very pleased with the service.

What we have done since the boys were born:

1) Canceled our gym memberships and instead, we take the boys to the mall and use that as our family exercise. This has saved us approximately $80 a month.

2) Cut back on eating out. We are fortunate that our boys are pretty well behaved and are very laid back when we are out in public, but cuts needed to be made and that was an easy one. So instead of eating out 2 – 3 times a week, we only eat out 1 time every two weeks. We now cook more at home and cook more so that we have enough leftovers for 2 – 3 meals. (I’m working on an entry on recipes and sites that can help with cooking) This has saved us approximately $80 a week, and actually probably closer to $100 a week if you factor in taking our lunches now.

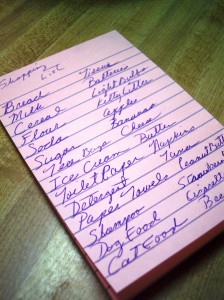

3) Coupons and more coupons. See more about what we our coupon experience. This has saved us approximately $25 – $30 a week.

4) I would stop at Starbucks at least 5 days a week and wouldn’t think twice about it. Now, I only go once a week. A savings of $20 a week.

5) Hand Me Downs – Don’t judge. The reality is that kids only wear clothes usually a few times before they have outgrown them. With twins, double the cost, it only makes sense to hook up with someone with older kids that have outgrown their clothes, it definitely saves a lot of money.

What we still need to do:

1) Almost 2 years ago during a snow storm, pre-twins, my wife and I upgraded our Comcast package to the $200 a month plan. Now, we watch only a few channels, primarily The Food Network and sports, so we will need to scale our cable package down. And we love Comcast and the service that we have gotten thus far, we just don’t need to spend $200 a month right now.

2) Signup for the Dave Ramsey Financial Peace University class.

3) Learn how to process our own food to cut down on paying for solid foods.

4) Increase our coupons, as this appears to be a huge savings for us.

5) Buy in bulk. Unfortunately for us, our house is small, which makes buying in bulk very limited, but when we can, we do stock up on the essentials, like diapers, formula, toilet paper, paper towels, etc.

I hope that these tips help. I have a feeling that this will be updated on a regular basis. If you have any ideas/suggestions, please feel free to share them with us.

phone (Out of Milk app for the Droid is awesome) I ran over to both Target and the grocery store. The primary objective was baby food from Target and food for the crock pot from the grocery store.

phone (Out of Milk app for the Droid is awesome) I ran over to both Target and the grocery store. The primary objective was baby food from Target and food for the crock pot from the grocery store.